Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. The articles and research support materials available on this site are educational and are not intended to be investment Book balance or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. A payment is made by the bank on behalf of the account holder without the latter issuing a check (e.g. standing order payments for rent or insurance premiums). After many years in the teleconferencing industry, Michael decided to embrace his passion for

trivia, research, and writing by becoming a full-time freelance writer.

Bank account service charges might have been deducted from a company’s bank account throughout and at the end of the month. Those debits would not be recorded in the book balance until the month-end numbers are reconciled with the bank. Companies perform bank reconciliation to match the cash balance in company’s cash account and the cash balance according to its bank statement.

Fact Checked

The company may sometimes record a deposit incorrectly, or it may deposit a check for which there are not sufficient funds (NSF). If so, and the bank spots the error, the company must adjust its book balance to correct the error. The bank may also charge an NSF fee, which must be recorded in the company’s books. Conversely, money received to Company ABC from Company LMN has been recorded in the book balance but has yet to show in the bank balance since the funds were not deposited in time before the bank’s month-end statement has been produced.

Since then, he has contributed articles to a

variety of print and online publications, including SmartCapitalMind, and his work has also appeared in poetry collections,

devotional anthologies, and several newspapers. Malcolm’s other interests include collecting vinyl records, minor

league baseball, and cycling. In true TY style, this plan is a full circle approach addressing your nutrition, movement, stress management, mindset, self-care and wellbeing. GIVING BACKLocal Nomad proudly donates 1% of sales to a different BIPOC centered organization each quarter. All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional.

5 Low Price-to-Book Stocks to Buy in August – Yahoo Finance

5 Low Price-to-Book Stocks to Buy in August.

Posted: Mon, 14 Aug 2023 12:06:00 GMT [source]

Interest earned on an account is often paid on a company’s cash balance and is credited to the bank account at the end of the month. The interest could be from a savings account or a cash sweep, which is when the bank withdraws unused funds in a company’s checking account and invests that money in short-term investments. The cash sweep allows the company to earn interest on their idle cash. In the context of a bank account, the book balance represents the amount of money a business or individual has in their account, as recorded by the bank. This balance might differ from the available balance, which reflects pending transactions, holds, or other adjustments that have not yet been fully processed and posted to the account.

What are Short-Term Investments?

Automatic deposits occur when the company’s checking account receives automatic fund transfers from customers or other sources or when the bank collects notes receivable payments on behalf of the company. The terms “bank balance” and “book balance” are used in the context of a company’s cash management and reconciliation of its bank statements. Also known as a gross balance, a book balance consists of the amount of funds that are on deposit in an account prior to making any type of adjustment to that balance.

Be aware that the Allow Web Query option is not available for this report. Add balance the books to one of your lists below, or create a new one. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

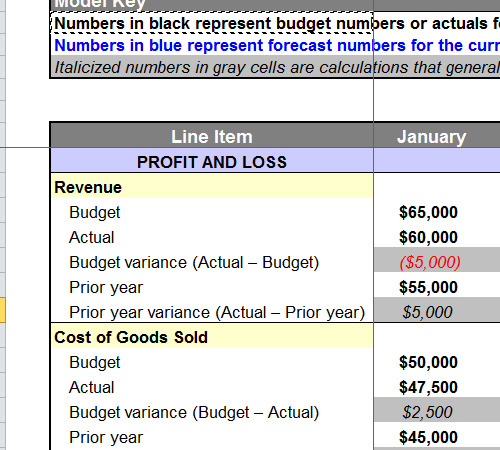

The term book balance, which is also used in the bank reconciliation is the amount shown in the company’s general ledger for the bank account. In other words, the book balance represents a running tally of a company’s account balance when considering all transactions, some of which have yet to be reconciled through the bank account. The Multi-Book Balance Sheet Detail report shows the starting and ending balances for the period of time specified on the report. It also shows transactions entered in the account for the time period you select for the two specified accounting books. Suppose that at the end of May, according to your company’s ledger (your “books”), your company has a balance of $10,000 in its bank account. Service charges are charged by the bank for its services in maintaining the checking account, and must be subtracted from the company’s book balance.

Difference Between Coronavirus and Influenza

Banks would obviously show only those checks on the bank statement that have actually been presented to them and paid by them on behalf of the account holder. Checks issued by the account holder to their suppliers may not have been presented to the bank for payment by the last day of the month to which the bank statement relates. The notification of bank charges may have been sent by the bank before the month-end but may have been received by the account holder after the month-end. The book of balance is a book held in place of a shield, and is the god book aligned with Guthix. It can be received as a reward from the Horror from the Deep quest.

- Since the Vector Management Group paid Ad It Up $63 more than the books show, a $63 debit is made to decrease the accounts payable balance owed to Ad It Up, and a $63 credit is made to decrease cash.

- From time to time, there are errors and adjustments that need to be made to bank transactions that would lead to discrepancies between the book balance and bank balance.

- Second, the company may have incorporated a deposit in transit into its book balance, but the bank has not yet processed it, so it does not appear in the bank balance.

- Although separate journal entries for each expense can be made, it is simpler to combine them, so bank fees expense is debited for $70 and cash is credited for $70.

Since the NSF check has previously been recorded as a cash receipt, a journal entry is necessary to update the company’s books. Therefore, a $345 debit is made to increase the accounts receivable balance of Hosta, Inc., and a $345 credit is made to decrease cash. When the difference between the calculated book balance amount and the adjusted bank balance amount equals zero, compare the calculated book balance amount to your general ledger for the current period-ending date. Knowing the book balance as of a specific date is important for several reasons.

Ask a Financial Professional Any Question

In practice, the balance in the cash book rarely agrees with the balance in the bank statement. The following are the reasons why disparities may exist between the two. Use Account Inquiry to verify the GL account balance matches the book balance. Since the Vector Management Group paid Ad It Up $63 more than the books show, a $63 debit is made to decrease the accounts payable balance owed to Ad It Up, and a $63 credit is made to decrease cash. If an adjustment is entered in the Bank Reconciliation module, this adjustment must be posted to the General Ledger module, so that the two modules balance.

This is the case when there are bank fees or electronic transfers on the bank statement that have not yet been recorded in the company’s general ledger accounts. For example, the bank statement may reveal that a bank service charge was withdrawn from the account on the last day of the month. A book balance is the account balance in a company’s accounting records. The term is most commonly applied to the balance in a firm’s checking account at the end of an accounting period.

This error is a reconciling item because the company’s general ledger cash account is overstated by $63. Reconciling these two balances is an important process, usually referred to as “bank reconciliation,” to ensure the accuracy of the company’s financial records. The difference between cash book balance and bank statement balance results due to certain transactions been recorded by either the company or the bank. Such discrepancies are regularly noted due to time lags in processing transactions and lack of knowledge of certain charges debited to the company account by the bank. These discrepancies have to be reconciled through preparing a bank statement.

If the bank incorrectly recorded a transaction, the bank must be contacted, and the bank balance must be adjusted on the bank reconciliation. If the company incorrectly recorded a transaction, the book balance must be adjusted on the bank reconciliation and a correcting entry must be journalized and posted to the general ledger. While reviewing the bank statement, Vector Management Group discovers that check #1569 for $381, which was made payable to an advertising agency named Ad It Up, had been incorrectly entered in the cash disbursements journal for $318.

Example of Book Balance

For information about the permissions required to view and customize financial statements, see Permissions and Roles. In the footer of the report, you can select from filter lists to refilter report data. Multi-Book Accounting is available only in NetSuite OneWorld accounts. Please contact your sales or account representative to find out how to get Multi-Book Accounting.

This example illustrates how the book balance is calculated by accounting for all transactions that have been posted to an account. In this case, the cash account book balance reflects the net result of deposits, withdrawals, and other financial activities during the month. Regularly monitoring and reconciling the book balance with the bank statement balance helps ensure accuracy in your financial records and enables you to detect any errors or discrepancies. There are multiple differences between the bank balance and book balance. First, there are likely to be checks outstanding that were recorded in the company’s book balance, but which have not yet been presented to the bank, and so are not recorded in the bank balance. Second, the company may have incorporated a deposit in transit into its book balance, but the bank has not yet processed it, so it does not appear in the bank balance.

- (For an individual, the book balance is likely to be the balance appearing in the person’s check register.) It is common for the book balance to not agree with the balance on the bank statement as of the same day.

- When this happens, the bank returns the check to the depositor and deducts the check amount from the depositor’s account Therefore, NSF checks must be subtracted from the company’s book balance on the bank reconciliation.

- Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- When all differences between the ending bank statement balance and book balance have been identified and entered on the bank reconciliation, the adjusted bank balance and adjusted book balance are identical.

However, there are several scenarios when the book balance can differ from a company’s bank balance. Book balance includes transactions that a company has done during an accounting period, such as one quarter or a fiscal year. Typically, book balance is used to manage the cash within a company’s checking account. At the end of an accounting period, the book balance is reconciled with the bank statement to determine if the cash in the bank account matches the book balance. Bank statement balance is the cash balance recorded by the bank in bank records.

The term is also used to refer to the balance that is present in an account on the last day of the current banking period, or the end of the business month. From this perspective, the book balance can be viewed as the starting point for reconciling the account records held by the bank and the records maintained by the account holder. At the end of each month, the cash book is not balanced until a bank statement is received from the bank. This process of adjusting the book balance to match the bank balance is known as bank reconciliation.

In the journal entry below, cash is debited for $18 and interest revenue is credited for $18. Companies may authorize a bank to automatically transfer funds into or out of their account. Automatic withdrawals from the account are used to pay for loans (notes or mortgages payable), monthly utility bills, or other liabilities.